Drive customer acquisition with differentiated value

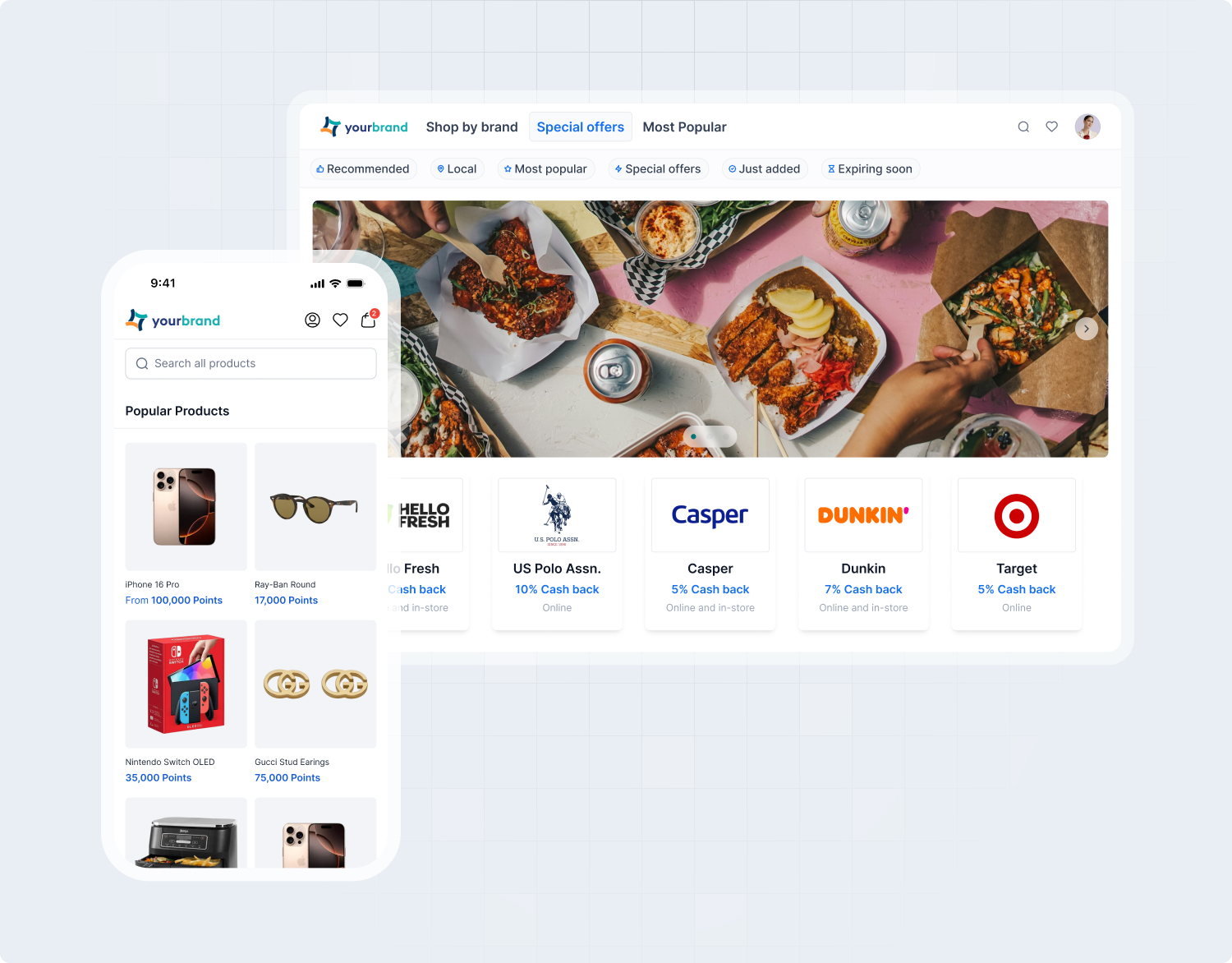

Consumers today have more banking options than ever. By integrating commerce and brand based rewards, financial institutions can offer exclusive product and shopping rewards, cashback opportunities, and personalized incentives that create a compelling reason for new customers to join. Meaningful rewards and incentives help you stand out in a crowded marketplace and attract new account holders.

- 79% of consumers are more likely to select a financial institution that offers a strong rewards program

- 60% of customers are willing to switch banks for valuable incentives, rewards and cashback

Increase customer retention & engagement

Once a customer opens an account, ongoing engagement is crucial. A well-structured rewards program fosters deeper interactions, ensuring customers continue to engage with and choose your financial services.

- Reward customers for everyday spending, with meaningful brands and commerce partners

- Personalize rewards based on purchase behavior

- Integrate commerce rewards in your consumer marketing outreach and across digital customer touchpoints

- Make commerce and brand based rewards visible and simple to redeem

Keep your card top-of-wallet

With multiple payment methods available, it’s essential to drive card preference. A rewards-driven incentive structure motivates customers to use your card for their daily and larger purchases.

- Higher reward rates for specific merchant partners across key spending categories (e.g., dining, travel, groceries)

- Merchant and brand funded offers that maximize reward value cost effectively

Customers who engage with a rewards program use their cards 33% more frequently than those without one.

The power of leading merchants in your program

Partnering with top-tier merchants and brands adds significant value to your loyalty program. By offering customers access to exclusive deals from industry-leading retailers, brands and merchant partners, financial institutions can enhance customer satisfaction and increase transaction volume.

- 92% of consumers prefer loyalty programs that feature well-known and frequently used merchants

- 50% of customers actively seek financial products that provide discounts or cashback from their favorite

- Merchant-funded rewards reduce program costs while increasing card usage and spending volume

How a rewards program prevents customer churn

Many customers switch banks due to high fees, poor service, or a lack of recognition, reward or incentives. A Commerce Reward Program combats these issues by:

- Providing financial benefits like cashback, discounts, lower fees and customer recognition

- Offering personalized rewards that align with customer spending patterns

- Creating new marketing opportunities and enhanced marketing cut-through association to preferred merchant and brand partners

- Creating deeper engagement through seamless integration into daily digital interactions and transactions

- Building trust with transparent and fair rewards structures